top broker in india

Welcome to the Largest Expert Guide to Binary Options and Binary Trading Online. BinaryOptions.net has been educating traders globally since 2011 and all of our articles are written by professionals who make a living in the finance industry. We have a thousand articles and reviews to guide you to be a more profitable trader in 2019, no matter what your current experience level. If you want to discuss trading or brokers with other traders, we have the world’s largest forum with over 20,000 members and daily activity. Read on to start trading today!

top broker in india

General risk warning: your capital is at risk

* Amount is credited to the account in case of successful investment

Quick Links

Compare Broker Bonus Low Deposit Broker Demo Account

Robots and Auto Trading Strategy Scams

What is a binary option and how do you make money?

A binary option is a fast and extremely simple financial instrument that allows investors to speculate whether the price of an asset will go up or down in the future, for example Google’s share price, Bitcoin price, USD/GBP exchange rate, or price of gold. Time periods can be as little as 60 seconds, making it possible to trade any global market hundreds of times per day.

Before you make a trade you know how much profit you make if your prediction is correct, usually 70-95% – if you invest $100 you will get $170 – $195 on a successful trade Will get credit of Rs. This makes risk management and trading decisions much simpler. The result is always a yes or no answer – you either win it all or you lose it all – so it is a “binary” option. The risk and reward are known in advance and this is one of the attractiveness of structured payoff.

Exchange traded binaries are also now available, meaning traders are not trading against a broker.

To start trading you first need a regulated broker account (or a licensed one). Choose from a list of recommended brokers, where only those brokers have shown themselves to be trustworthy. The top broker has been chosen as the best option for most traders.

If you are completely new to binary options, you can open a demo account with most brokers to try out their platform and see what it is like before depositing real money.

Introduction Video – How to Trade Binary Options

This video will walk you through the concept and trading operations of Binary Options. If you want to know even more details, please read this entire page and follow the links to all the more in-depth articles. Binary trading doesn’t have to be complicated, but as with any discipline you can educate yourself to become an expert and perfect your skills.

type of option

The most common type of binary option is the simple “up/down” trade. However, there are a variety of options. A common factor, is that the result will have a “binary” result (yes or no). Here are some types available:

- Up/Down or High/Low – The basic and most common binary option. Will the price be higher or lower than the current price at the time of expiry.

- In/Out, Limit or Range – This option sets a “high” figure and a “low” figure. Traders speculate whether the price will end up inside, or outside, these levels (or ‘ranges’).

- Touch / No Touch – These set higher or lower levels than the current price. The trader must predict whether the actual level will ‘touch’ those levels at any point in time at the time of expiry of the trade. Note that with one touch options, the trade may be closed before the time of expiry – if the option If the price level is touched before expiration, a “Touch” option will pay immediately, even if the price moves away from the touch level.

- Ladder – These options behave like a normal up/down trade, but instead of using the current strike price, the ladder will have preset price levels (‘staircased’ progressively up or down). These can often be some way from the current strike price. , Typically these options require a significant price move, the payoff will often exceed 100% – but both sides of the trade may not be available.

How to trade – Step by step guide

Below is a step by step guide to placing binary trades:

- Choose a Broker – Use our broker reviews and comparison tools to find the best binary trading site for you.

- Select an asset or market to trade – The list of assets is huge, and cover commodities, stocks, cryptocurrency, forex or indices. For example, the price of oil, or the price of Apple stock.

- Select the expiry time – Options can expire anywhere between 30 seconds up to one year.

- Set the trade size – Remember that 100% of the investment is at risk so consider the trade amount carefully.

- Click on Call/Put or Buy/Sell – Will the asset rise or fall in price? Some brokers label buttons differently.

- Check and confirm the trade – Many brokers give traders a chance to make sure of the details before confirming the trade.

choose a broker

Options fraud has been a significant problem in the past. Fraudsters and unlicensed operators exploited binary options as a new exotic derivative. These firms are disappearing thanks to regulators finally starting to act, but traders still need to look for regulated brokers.

pay attention! Do not trade with a broker or use a service on our Blacklist and Scams page that we recommend here on the site. Here are some shortcuts to those pages that can help you determine which broker is right for you:

- Compare all brokers – If you want to compare features and offers of all recommended brokers.

- Bonuses and Offers – If you want to be sure that you will get extra money for trading, or other promotions and offers.

- Low minimum deposit brokers – If you want to trade without having to deposit large sums of real money.

- Demo account – if you want to try a trading platform “for real” without depositing money.

- Halal Brokers – If you are one of the growing number of Muslim traders.

asset list

The number and variety of assets you can trade can vary from broker to broker. Most brokers offer options on major forex pairs including popular assets such as EUR/USD, USD/JPY and GBP/USD, as well as major stock indexes such as the FTSE, S&P 500 or Dow Jones Industrial Average. Commodities including gold, silver, oil are also commonly offered. Individual stocks and equities are also tradable through many binary brokers. While not every stock will be available, you can usually choose from about 25 to 100 popular stocks, such as Google and Apple. These lists are growing all the time according to demand. Asset lists are always clearly listed on every trading platform, and most brokers make their full asset lists available on their websites. Full property listing information is also available within our reviews.

expiry times

Expiration time is the point at which a trade is closed and settled. The only exception is where a predetermined level has been hit prior to the expiry of the ‘one touch’ option. The expiry of any given trade can range from 30 seconds to over a year. While binaries initially started with very few expirations, demand has ensured that there is now a wide range of expirations available. Some brokers also give the traders the flexibility to set their own specific expiry time.

Expiry is generally divided into three categories:

- Short Term / Turbo – These are generally classified as any expiry under 5 minutes

- Normal – These expire from 5 minutes to ‘end of day’, which expires when the local market closes for that asset.

- Long term – Any expiry beyond the end of the day will be considered long term. The longest the expiry can be is 12 months.

Regulation

In response to the slow pace of binary options, regulators around the world have now begun to regulate the industry and make their presence felt. Major regulators currently include:

- Financial Conduct Authority (FCA) – UK regulator

- Cyprus Securities and Exchange Commission (CySec) – The Cyprus regulator, often given a ‘passport’ throughout the EU, under MiFID.

- Commodity Futures Trading Commission (CFTC) – US regulator

- Australian Securities and Investments Commission (ASIC)

Regulators are also operating in Malta and the Isle of Man. Many other authorities are now taking an interest in binaries, especially in Europe where domestic regulators are keen to control CySEC regulation. Unregulated brokers still operate, and while some are trustworthy, regulation is lacking. Scarcity is a clear warning sign for potential new customers.

esma

Recently, ESMA (European Securities and Markets Authority) moved to ban the sale and marketing of binary options in the European Union. The restriction, however, only applies to brokers regulated in the European Union. This leaves traders with two options for placing trades: First, they can trade with an unregulated firm – this is very high risk and not advisable. Some unregulated firms are responsible and honest, but many are not.

The other choice is to use a firm regulated by bodies outside the EU. In Australia ASIC are a strong regulator – but they will not enforce the ban. This means that ASIC regulated firms can still accept EU traders. Check out our Broker List for regulated or trusted brokers in your area.

There is also a third option. Traders who register as ‘professional’ are exempted from the new ban. The restriction is designed to protect only ‘retail’ investors. A professional trader can continue trading on EU regulated brokers such as IQ Option. To be classified as a professional, an account holder must meet two of these three criteria:

- Open 10 or more trades of €150 or more per quarter.

- have assets of €500,000 or more

- Has worked in a financial firm for two years and has experience in financial products.

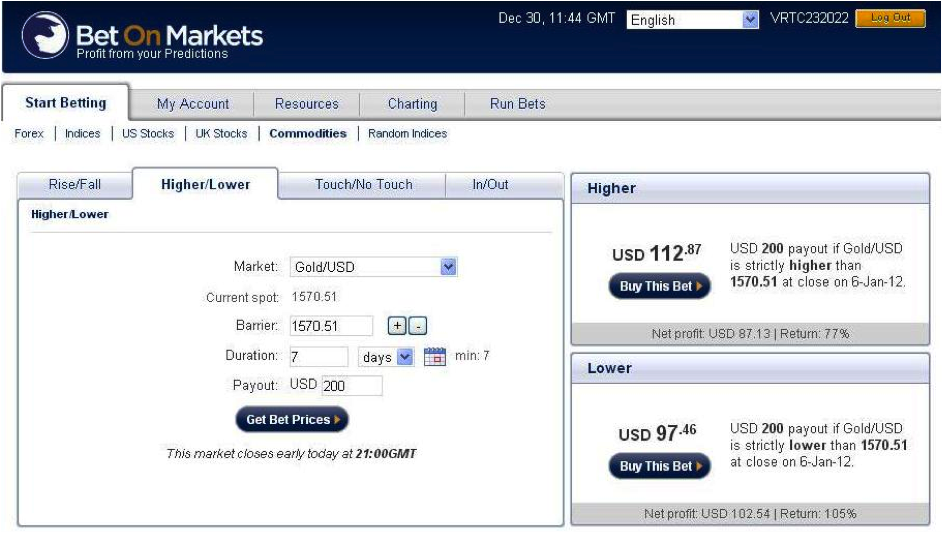

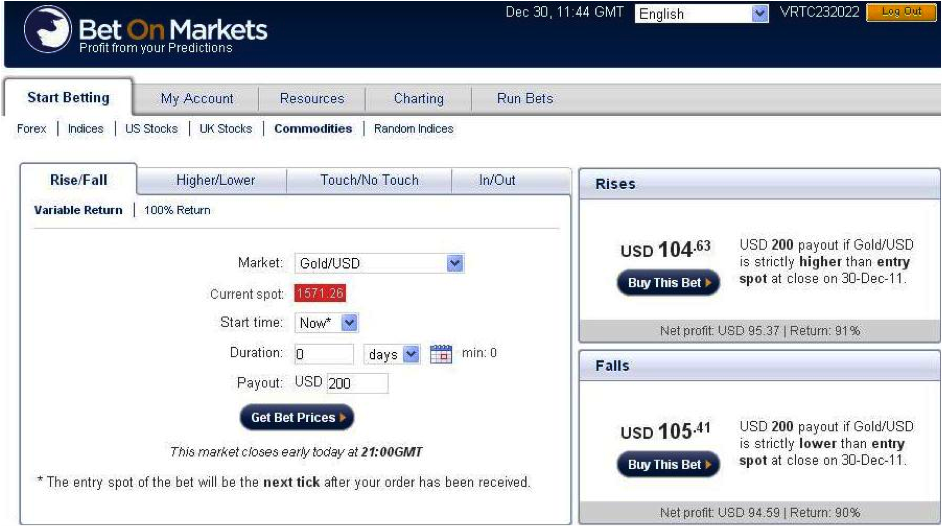

high Low

Also called an up/down binary trade, the essence is to predict whether the market price of an asset will exceed or fall below the strike price (selected target price) before expiration. If the trader expects the price to rise (trading “up” or “high”), he buys a call option. If he expects the price to go down (“low” or “down”), he buys a put option. The expiry time can be as low as 5 minutes.

Please note: Some brokers classify Up/Down as separate types, where a trader buys a call option if he expects the price to move above the current price, or buys a put option if He expects the price to move below the current prices. You can see this as a rise/fall type on some trading platforms.

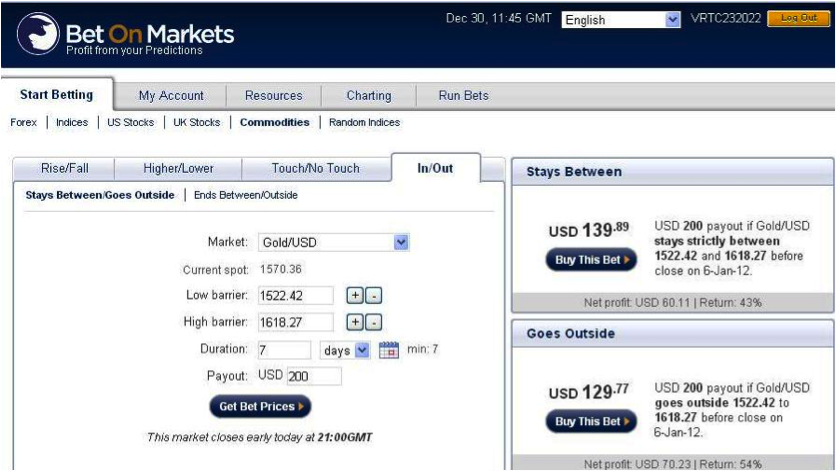

Inside Out

The In/Out type, also called “tunnel trading” or “boundary trading”, is used to trade price consolidations (“in”) and breakouts (“out”). How does this work? First, the trader sets two price targets to form a price range. He then buys an option to speculate whether the price will remain within the price range/tunnel until expiration (the then) or if there will be a breakout of the price range in the price direction (the out).

The best way to use tunnel binaries is to use asset pivot points. If you are familiar with pivot points in forex, you should be able to take this type of trade.

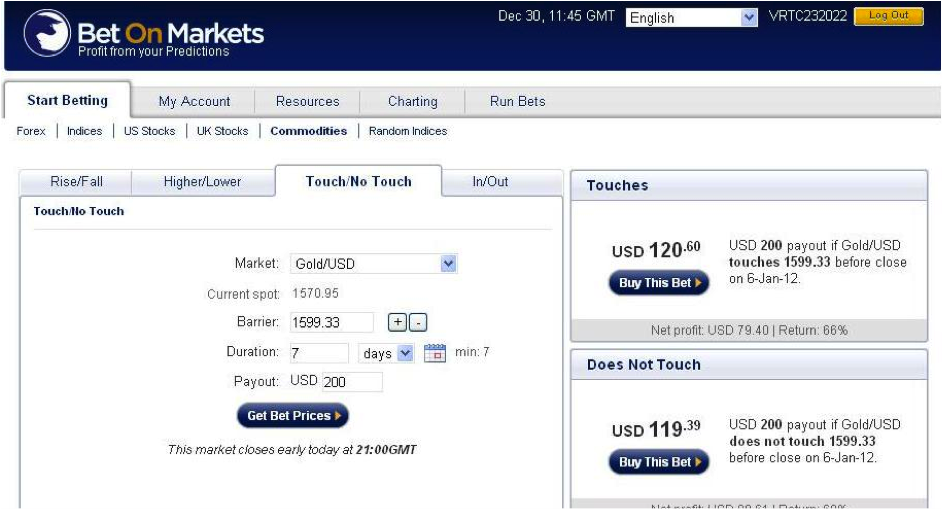

touch / no touch

This type of price action is predicted to touch a price barrier or not. A “touch” option is a type where the trader buys a contract that will provide a profit if the market price of the purchased asset touches a specified target price at least once before expiration. If the price action does not touch the price target (strike price) before expiry, the trade will end in loss.

A “no touch” is the exact opposite of a touch. Here you are not touching the strike price prior to expiry on the price action of the underlying asset.

There are variations of this type where we have double touch and double no touch. Here the trader can set two price targets and buy a contract that bets on the price touching both the targets before expiry (Double Touch) or not touching both the targets before expiry (Double No Touch). Typically you would only employ the double touch trade when there is intense market volatility and price is expected to take out multiple price levels.

Some brokers offer all three types, while others offer two, and there are others that offer only one. Furthermore, some brokers also put restrictions on how expiration dates are set. To get the best out of the various types, traders are advised to shop around for brokers who can give them maximum flexibility in terms of types and expiry times that can be set.

mobile apps

Trading through your mobile has become very easy as all the leading brokers provide fully fledged mobile trading apps. Most trading platforms are designed with mobile device users in mind. So the mobile version will be very similar, if not identical, as the full web version on traditional websites.

The broker will cater for both iOS and Android devices and will create versions for each. Downloads are quick, and traders can sign up through the mobile site as well. There are more details about each broker mobile app in our reviews, but most are fully aware that this is a growing area of business. Traders want to react quickly to news events and market updates, so brokers provide tools for clients to do so wherever they are.

Trading FAQ

What is meant by binary options?

“Binary Options” means, put very simply, a trade where the outcome is a ‘binary’ yes/no answer. If the binary trade loses, these options pay a fixed amount if they win (known as “in the money”), but the entire investment is lost. So, in essence, they are a fixed return financial option.

How does stock trading work?

Steps to trade stocks through a binary option;

- Select Stock or Equity.

- Identify the desired expiration time (the time the option expires).

- Enter trade or investment size

- Decide whether the price will rise or fall and place a put or call

The above steps will be the same for each broker. More layers of complexity can be added, but the simple up/down trade type remains the most popular when trading parity.

put and call options

Call and Put are simply terms given to buy or sell options. If a trader believes that the underlying will increase in value, they can open a call. But they can place a put trade where they expect the price to go down.

Different trading platforms label their trading buttons differently, some even switch between Buy/Sell and Call/Put. Others skip the put phrases and call altogether. Almost every trading platform will make it clear in which direction a trader is opening an option.

Is binary options a scam?

As a financial investment instrument they are not a scam in themselves, but are brokers, trading robots and signal providers that are untrustworthy and unscrupulous.

The point is not to write off the concept of binary options entirely based on unscrupulous brokers. The reputation of these financial instruments has suffered as a result of these operators, but regulators are slowly starting to prosecute and fine the offenders and the industry is being cleaned up. Our forum is a great place to raise awareness about any wrongdoing.

These simple checks can help anyone avoid scams:

- Marketing promising huge returns. This is a clear warning sign. Binaries are a high risk / high reward tool – they are not a “make money online” scheme and should not be sold as such. Operators making such claims are likely to be untrustworthy.

- Know the broker Some operators will ‘funnel’ a new client to a broker they partner with, so the person has no idea who has their account. A trader should know the broker they are going to trade with! These funnels often fall into the “get rich quick” marketing discussed earlier.

- cold calls Professional brokers will not cold call – they don’t market themselves that way. Cold calls will often be from unregulated brokers who are only interested in getting the initial deposit. Proceed with great caution when joining a company that approaches you in this way. This would also include email contact – any form of contact out of the blue.

- Terms and conditions . When taking up a bonus or offer, read the full terms and conditions. Some will include locking in the initial deposit (other than bonus funds) until a high volume of trades have been made. The first deposit is trader’s cash – legitimate brokers will not claim it before any trade. Some brokers also provide an option to cancel the bonus if it does not suit the trader’s requirements.

- Don’t let anyone trade for you. Avoid allowing any “Account Manager” to trade for you. There is a clear conflict of interest, but these employees of the broker will encourage traders to make larger deposits, and take more risks. Traders should not allow anyone to trade on their behalf.

What are the best trading strategies?

Binary trading strategies are unique to each trade. We have a strategy section, and ideas that traders can experiment with. Technical analysis is of use to some traders along with charts, indicators and price action research. Money management is necessary to ensure risk management for all investments. Different styles will suit different traders and strategies will also evolve and change.

There is no single “best” strategy. Traders need to ask questions about their investment objective and risk appetite and then find what works for them.

Are binary options gambling?

This will completely depend on the trader’s habits. Without a strategy or research, then any short term investment is going to win or lose based on luck alone. In contrast, a trader who places a well researched trade will ensure they have done all they can to avoid relying on good luck.

Binary options can be used to gamble, but they can also be used to make trades based on price and expected profits. So the answer to the question will come down to the trader.

benefits of binary trading

The main advantage of binaries is the clarity of risk and reward and structure of the trade.

minimal financial risk

If you’ve traded forex or its more volatile cousins, crude oil or metals like gold or silver, you’ve probably learned one thing: These markets carry a lot of risk and it’s very easy to get blown out of the market. Things like leverage and margin, news events, slippage and price re-quotes, etc. can all negatively affect a trade. The situation is different in binary options trading. There is no use fighting with it, and phenomena such as slippage and price re-quotes have no effect on the results of a binary options trade. This reduces the risk in binary options trading to the bare minimum.

resilience

The binary options market allows traders to trade financial instruments spanning the currency and commodity markets as well as indices and bonds. This flexibility is unparalleled, and gives traders with the knowledge to trade these markets, a one stop shop to trade all these instruments.

Simplicity

A binary trading result is based on just one parameter: the direction. The trader is essentially betting on whether a financial asset will end up in a particular direction. Furthermore, the trader is at liberty to determine when the trade will end, by setting an expiry date. This gives a trade that started poorly a chance to end well. This is not the case with other markets. For example, losses can be controlled by using a stop loss. Otherwise, a trader faces a drawdown if a trade takes an unfavorable turn giving him room to turn profitable. The simple point here is that in binary options, the trader has less to worry about than if he were to trade other markets.

Greater control of trades

Traders have better control of trades in binaries. For example, if a trader wants to buy a contract, he knows in advance what he stands to gain and what he stands to lose if the trade is out-of-the-money. This is not the case with other markets. For example, when a trader sets up a pending order in the forex market to trade a high-impact news event, there is no assurance that his trade will be filled at the entry price or at the exit price. A losing trade at the stop would be at a stop loss.

high pay

Payouts per trade are usually higher in binaries than in other forms of trading. Some brokers pay up to 80% on the trade. This is achievable without jeopardizing the account. In other markets, such payouts can only happen if a trader disregards all money management rules and exposes a large amount of trading capital to the market expecting a huge payout (which in most cases never happens). It happens).

easy access

In order to trade in the highly volatile forex or commodities markets, a trader must have a reasonable amount of money in the form of trading capital. For example, trading gold, a commodity with intra-day volatility of up to 10,000 pips in times of high volatility, requires trading capital in the tens of thousands of dollars. However, binary options have very low entry requirements, as some brokers allow people to start trading with as little as $10.

Binary Trading Disadvantages

Reduced trading odds for Sure-Banker trades

The payout for binary options trades tends to be very low when the probability of that trade being successful is very high. While it is true that some trades pay as much as 85% per trade, such high payouts are only possible when trading with an expiration date set at some distance from the trade date. Of course in such situations, trades are more unpredictable.

Lack of good trading tools

Some brokers do not provide really helpful trading tools like charts and facilities for technical analysis to their clients. Experienced traders can get around this by sourcing for these tools elsewhere; Inexperienced traders who are new to the market are not as lucky. This is for the better, however this is changing as operators mature and become aware of the need for these tools to attract traders.

Limitations on Risk Management

Unlike forex, where traders can find accounts that allow them to trade mini and micro-lots at smaller account sizes, many binary options brokers set up a trading floor; The minimum quantity that a trader can trade in the market. This makes it easy to lose a lot of capital when trading binaries. As an example, a forex broker may allow you to open an account with $200 and trade micro-lots, which allow a trader to expose only an allowable amount of their capital to the market. gives. However, you will be hard pressed to find many binary brokers that will allow you to trade below $50 even with a $200 account. In this case, four losing trades will blow the account.

cost of losing trades

Unlike other markets, where the risk/reward ratio can be controlled and set to give an edge to winning trades, binary options probabilities tilt the risk-reward ratio in favor of losing trades.

business improvement

When trading like the forex or commodities market, it is possible to close a trade with a minimal loss and open a more profitable one if a repeated analysis of the trade shows that the first trade made a mistake. Was. Where binaries are traded on an exchange, but it is depreciated.

spot forex vs binary trading

These are two different options, traded with two different psychologies, but both can make sense as investment tools. One is more TIME focused and the other is more PRICE focused. They both work in time/cost, but there’s an interesting divide when you focus on one over the other. Spot forex traders may ignore time as a factor in their trading which is a huge mistake. The successful binary trader has a more balanced time/price approach, which simply makes him a more well-rounded trader. Binaries by their very nature force to exit or lose a position within a given time frame which puts more focus on discipline and risk management. This lack of discipline in forex trading is the #1 reason for failure for most traders as they will hold losing positions for longer periods of time and cut winning positions in shorter periods of time. In binary options that is not possible with time expires your trade is won or lost. Below are some examples of how this works.

Above is a buy trade on the EUR/USD price and the bottom of the 10 minute time window. As a binary trader this focus will naturally make you better off than the example below, where a spot forex trader who focuses on price while ignoring the time element ends up in trouble. Being able to focus on ranges and this psychology of dual pivot will help you become a better trader.

The very advantage of spot trading is its very failure – the rapid expansion of profits by 1 point in price. That is to say, if you enter a position that you believe will increase in price and are bullish to the downside if the price does not increase, the general tendency for most spot traders is to wait. or add them to the losing positions. It will come back. The timely acceleration in the opposite desired direction causes most spot traders to get stuck in unfavorable positions, all because they do not plan the timing in their logic, and this leads to a complete lack of trading discipline.

The very nature of binary options forces one to have a more complete trading mindset of closing both the Y = price range and the X = time range. They will make you a better overall trader from the start. Rather, on the contrary, they by their very nature require a higher win rate as each bet means 70-90% profit versus 100% loss. So your win rate needs an average of 54%-58% to break even. This imbalance causes many traders to overtrade or take revenge trades which is just as bad as holding/adding losing positions as a spot forex trader. To trade successfully you need to practice money management and emotional control.

Finally, when starting out as a trader, binaries can provide a better foundation for learning trading. The simple logic is that attention to the TIME / PRICE joint is like going both ways when crossing a street. The average spot forex trader only looks at price, which means he is only looking in one direction before crossing the street. Learning to trade with both time and price in mind should help in making a holistic trader.

References and further reading

- A Study of Optimal Stock and Options Strategies (Dash, Mihir and V., Kavitha and KM, Deepa and S., Sindhu, 2007)

- Is There Money Investing in Options: A Historical Perspective (Doran, James and Fodor, Andy, 2006)

- An Investor’s Guide to Trading Options (Virginia B. Morris, Bess Newman – Lightbulb Press, Inc. 2004)

- Trading Binary Options: Strategies and Tactics (Abe Kofnas – John Wiley & Sons, 2011)

- Binary Options: Fixed Odds Financial Bets (Hamish Raw – Harriman House Ltd, 2011)

- Binary Options: Strategies for Directional and Volatility Trading (Alex Necritin – John Wiley & Sons, 2012)

- How to Trade Binary Options Successfully: A Complete Guide to Binary Options Trading (Meir Liraz – Liraz Publishing)

- Options Trading and Individual Investor Performance (R Bauer, M Cossman, P Eicholtz – Journal of Banking and Finance, Vol 3 Issue 4, 2009)

- Binary Options Pricing Using Fuzzy Numbers (A Thaneswaran, SS Appadu, J Frank – Applied Mathematics Letters, Vol 26, Issue 1, 2013)