Forex Trading – Trade Forex With The Best Forex Brokers

Forex trading is one of the most active and volatile markets – making it ideal for traders. Our guide to forex trading provides a starting point for beginners; Plus tips, strategy and education for experienced investors too. We explore forex trading hours, explain how to compare online trading platforms, how to manage risk and even find the best forex trading demo accounts.

So start your journey into the world of Forex here, and join a market that trades over $5 billion every day…

top forex broker in india

| Broker | regulated | minimum deposit | Payment | Bonus | |||

|---|---|---|---|---|---|---|---|

| IQ Option | $ 10 | 91% * | »go to | |||

| BDSwiss | $ 10 | N/A | »go to | |||

| 24Option | $ 100 | »go to | ||||

| Nadex | $ 250 | 100% | »go to |

General risk warning: your capital is at risk

* Amount is credited to the account in case of successful investment

a forex definition

Foreign exchange (foreign exchange) is the exchange of one currency for another. Global businesses, governments and holiday makers all need to exchange currencies at different times (though in vastly different amounts). The foreign exchange markets allow them to do so. The normal forces of supply and demand will determine the movement of those exchange rates – and forex trading is active speculation of those exchange rates.

Forex trading revolves around ‘pairs’. These two currencies are being represented. The exchange rate is said to be how much of the second currency is needed to buy 1 of the first. So if the EUR/USD pair is showing ‘1.1811’, it means that 1.18 US dollars is needed to buy 1 Euro. Exchange rates will often be quoted to 6 decimal places. Online forex trading platforms will allow retail investors to speculate on the movement of these rates.

How to start Forex trading

Retail investors can start forex trading using online platforms and software from many forex brokers. However, one difficulty is which broker to choose. One major issue is that the best broker for one trader, may not be suitable for another.

There are a large variety of comparison factors to consider when looking at forex brokers. Many people will look at the offers and spreads, the leverage or margin required to trade, the assets available such as gold or bitcoin or even if the broker is based in a well regulated jurisdiction such as the UK or Switzerland.

We include all of these popular factors in our reviews, but we also try to include some comparative factors that may have been overlooked, such as minimum deposit and trade size, spread type (is it fixed or variable, ) and deposit and withdrawal methods as PayPal or Skrill. Some of these factors will be important to some traders, but irrelevant to others. This makes it difficult to suggest the “best” broker that will suit everyone – but we still give each broker a rating.

demo account

In addition to our comparison lists, potential new traders can use demo accounts to test out different brokers and see what they like. This is especially important when it comes to usability or look and feel. Opinions will often differ on different online trading platforms. The best way to judge a particular platform is to use it. It also allows new clients to check the assets they trade are often available, and the spreads are competitive.

In summary, here is a list of factors that are worth considering when looking at different forex brokers:

- Offer / Spread (Trading Cost)

- margin or leverage flexibility

- minimum deposit

- Software integration – eg MT4 (MetaTrader 4)

- Assets (the markets you want available, such as Oil, GBP/JPY or Bitcoin etc.)

- regulation

- demo account

- Bonus

- mobile trading app

Beyond these there can be other important considerations such as does the broker accept traders from a particular country? Some regions such as Australia and the US have different regulatory bodies and many brokers may not be able to service those regions. Our broker tables usually only show relevant brands based on your IP.

Benefits of trading the forex market

One of the biggest advantages of options trading in the forex market is that the brokers are flexible and allow you to trade variations. Furthermore, you can get 80% or more returns in a matter of minutes by predicting the price movement of currency pairs.

Get the most out of your forex trading

A typical trade involves choosing a currency pair. For example, you choose EUR/USD and decide whether the pair will expire above or below its current price in one hour. You will choose the ‘call’ option if you anticipate the price will go up or the ‘put’ option if you think the price will fall below the current price. If the closing price is above the price you bought with the ‘call’ option, you will be ‘in the money’ at the time of expiry. If you choose a ‘Put’ option and the closing price is lower than the price you bought at, you will also be ‘in the money’ and can make 60 to 80% or more on the trade. Even the tiniest of a pip at or under your strike price can get you a profit in less than an hour. However, in traditional forex trading you would need to get at least 81 pips on a $1000 x 100 leveraged trade.

a powerful hedging tool

With shorter expiry terms you can take advantage of any news event that may trigger market volatility instead of a stop-loss. One of the most interesting applications of Forex binary options is that they can be used as a powerful hedging tool. This allows traders to shift any risk from the buy point from the bottom to the top. If you take a traditional long position EUR/USD with a stop/loss and also buy a binary ‘put’ option, you can cover any losses or gains in the event of an unsuccessful long position trade. Risk is shifted above the bottom of the stop/loss. If the rally continues in the right direction, you can end up with a successful trade. This makes investing in binary options more fun, exciting and less stressful for the novice trader as well. Mifune’s for more information on hedging.

Fundamentals of Trading Forex Binary Options

One of our professional traders, and founder of a money management and trade advisory firm, shares his thoughts on the fundamentals of trading forex binary options and the system he uses.

The strategy I want to talk about is nothing secret – although it is also not very common – and the reason for its success is its simplicity.

The currency pair that I primarily trade (90%) is the Euro Dollar pair. This is simply because it is the most volatile and predictable pair. The euro-dollar is the most traded pair, and since the opening of the forex market to retail investors, its daily volume has increased dramatically. The Euro-Dollar is also a common pair used by financial firms to hedge their client’s revenue against market swings.

The main problem I see every day when reading through binary options forums is the sheer number of different strategies out there. Traders seem to think that the more complex the system, the better the profits. Then, when they fail, they blame the system they were using, when in reality, the problem lies behind the screen. No system will ever adapt to changing market conditions; It is up to the trader to optimize the approach.

I know some will argue that this will not work in this or that market condition, but they forget that the market itself is binary; Price can only go up or down. Such a thing as a market does not exist. Every trading system is also at its core – the system’s job is to find the best entry and exit points for the trader.

As an example: An experienced trader will quickly locate support and resistance levels on a chart. A scoundrel won’t do. The rookie will implement a strategy using Stochastic, MACD and RSI, but what he doesn’t realize is that these indicators give him the same entry points that the experienced trader uses.

For binary options, the knowledge of how to find the best entry points along with predicting the next price move is vital. With binary options every 10th one pip counts.

Disclaimer: This section represents my personal opinion and strategy I have personally used. Please read everything carefully, and do not jump to use a high risk strategy before fully understanding how it works. Trade using a demo account before going live. This strategy is the holy grail for me because I’m not too greedy and if I don’t feel like it I just take the trade, and wait for the next one.

forex fundamentals

It is important to understand what foreign exchange is and what its main use is: the exchange of currencies governed by the laws of supply and demand.

A simple hypothetical example: Apple sells 1 million iPhones in Europe in September for 500 million Euros a piece as the base currency, they do the deal through HSBC, which means their Receivable Account is subject to HSBC . But Apple reports in dollars, and the governing account is with the BOA.

So Apple earned 500 million Euros which is now sitting in their HSBC account in Luxembourg. That money is now transferred to his BOA account and converted into USD.

Now it gets interesting. The transfer order comes into force on Tuesday at 4pm GMT. It will not be transferred immediately. The bank deposits all dollar orders during the night. Orders can be from tomorrow or a month in advance. The bank sends operation orders to its partners (like us) and commission structure, and order deadline.

The euro-dollar is trading at 1.27000 at 6 GMT on Wednesday. Apple’s account in the BOA will be found to be worth USD 635 million at 8am EST. The order is set at 1.27000. So how will we and both the banks get the most out of that order?

BOA gets their commission from Apple, but what about HSBC?

At 8:00 GMT, London opened with a liquidity of 380 million euros and a price of 1.27010. So 500 million Euro is equal to 635 050 000 USD. Not enough money in the market yet, but not good yet, and not remarkable.

The Euro outlook is bullish, Asian markets rallied during the night and the US fiscal cliff is being resolved. Millions of retail investors and outlets place BUY orders and place their stops 10 pips below the current price. Pending liquidity in the market is €300 million and current liquidity is €380 million. So, at the moment the total equivalent liquidity in the market in USD (1.27010) is 482 638 000 USD and 381 030 000 USD pending (equivalent to stops).

The data tells us that the stops are at 1.26910, so at 8.15am GMT the sell order is 2,8 times more than the available liquidity (2,900 million Euro sell orders). The price moves to 1.26905 where our (bank + us) BUY orders are triggered and retail investors place new buy orders to cover their losses. The price flies up to 1.27099, and this is when we slowly start exiting our BUY positions, and because the trend still looks strong, people place our BUY orders. On your chart this is shown by the green candles in a smaller size after a good run to the upside.

So the market liquidity reached 380 + 300 = 680 million euros, and we exited at 1.27099, for a profit of 9.9 pips (from 1.27000). Not much you say, but we were given a leverage of 10% from Barclays on our position for a commission of 0.1 pip. So our 500 million EUR had a leveraged market value of 5 billion EUR, or 5 billion / 100 000 = 500 000 lots X 10 USD = pip value of 5 million USD X 9.9 pips = 49.5 million USD, or 36.1 million EUR. This is then shared between HSBC, us and Barclays.

The numbers above are just an example, the truth is the volume is huge (4 trillion USD daily) and there are a lot of players, but this example is just to show you how FX works, and the analysis of SR levels and trends. This is essential when doing

SR levels are defined by the big players (smart money) and they hold really well as retail investors use them as well. The smart money cycle occurs in 3 price cycles, and then we see a short term channel where price is stuck for a bit of accumulation power (GBPUSD last week during the US session).

A forex system – Fibonacci

These price cycles do not occur randomly, they have a sequence, and in fact there is a cycle and sequence inside each candlestick or price move. This sequence is defined by a set of Fibonacci numbers.

Fibonacci numbers were not developed for trading, and they occur everywhere around us in nature, where many biological systems can be described in terms of Fibonacci-like sequences.

The big players don’t use indicators like RSI, CCI or MACD, their algo is based on Fibonacci numbers.

And combining the Fibonacci algos with the extremely accurate price channel calculator and information on other trading channels you got the formula to rule all other systems and strategies.

Now, why would you care when trading binary options? Because unlike spot fx, you have to be right every time. Basically you have the ability to predict whether the candle is going to be red or green.

Trading during the day that doesn’t involve smart money orders, I want to bag easy pips, so I need to use something that defines price cycle moves and reversals. For Binaries and Spot FX Day Trading I use 3 indicators with very precise functions.

forex correlation

Forex correlation is an important trading tool. If you don’t know what they are, they can be hurting your business without you even realizing it. Correlations show us which forex move together, which move in opposite directions, and which ones have little to do with each other. This information then helps us determine which trades we should take, helps control risk, and may even provide additional trading opportunities not readily visible on the price chart.

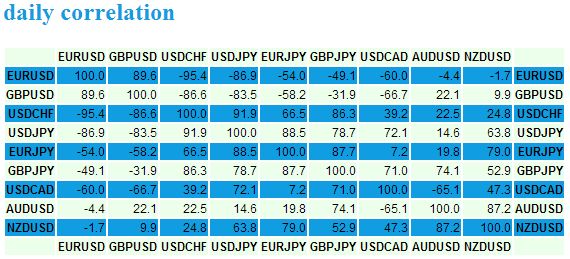

Forex correlations are usually shown in a table, with values ranging from -100 to 100. A value of -100 (negative numbers are called inverse correlations) means that the two exotic pairs move exactly opposite to each other—one rises when the other falls, and falls when the other falls. A value of 100 means that the two exotic currency pairs move in sync – when one rises, the other falls. It is very rare to find an asset that has 100 or -100 correlation to another asset. However as figure 1 shows, there are many forex pairs that have very high positive or negative correlations to each other.

Figure 1. Daily Forex Correlation (July 25, 2013)

Consider anything – / + 70 to be a noticable correlation, while anything – / + 80 a strong correlation. Using the chart above, find GBP/USD on the left and then EUR/USD on the top, then scroll to the box where the row and column meet. It shows that the correlation between GBP/USD and EUR/USD is 89.6. This means that most of the time, on a daily basis they are in sync with each other. This is important to know for reasons that will be discussed in the next section.

Now, find USD/CHF on the left, and then EUR/USD on top. Find the box where the row and column meet, and it shows that the correlation between these two pairs is -95.4. This means that they share a very strong inverse correlation. When EUR/USD goes up, USD/CHF goes down, and vice versa.

Sometimes there is no relevant correlation. If a pair’s correlation value (positive or negative) is less than 60 then the relationship is not very strong, and as we approach 0 there is no correlation between the pairs. Take NZD/USD and EUR/USD for example; The correlation between these pairs is -1.7, which means that there is no correlation between these pairs, on a daily basis. In other words, the rise or fall of NZD/USD tells us absolutely nothing about what EUR/USD might do.

Correlation tables are usually offered on the basis of hourly, daily and weekly time frames. All these timeframes provide valuable information depending on the timeframe you trade. The hourly and daily correlations will be most important for short term trading.

It’s also important to note that correlations change all the time. The roads that have a very strong correlation right now may not go down the road. Therefore, it is important to monitor correlations frequently to be aware of changing relationships between pairs.

Why does forex correlation matter?

There are many reasons to care about forex correlations. The main reason I monitor them is to control risk. For example, you may think that you can be “diversified” by taking on multiple trades at once.

If you are long (buy call) EUR/USD, GBP/USD and sell (buy) USD/CHF you have essentially taken 3 very similar positions. If someone goes against you, they will probably go against you. You haven’t reduced your risk through diversification; You have actually tripled your risk!

Another reason forex correlations is that they can provide you with trades that you may not have seen. For example, you believe the EUR will appreciate against the USD (i.e. EUR/USD will go up), but you look at the charts and don’t see a great trade set-up. Since you know that GBP/USD usually moves with EUR/USD (based on current correlation), you can also look at GBP/USD to see if there is a better trade set-up. You will also want to see if there is a trade set-up to buy short (go put) USD/CHF, as it usually moves in the opposite direction to EUR/USD. High correlations (positive to negative) provide you with alternative trades; Select the one with the best trading set-up.

I love using forex correlations to confirm trades. When finding forex pairs with high correlations, I will use one pair to confirm trades in the other. For example, if EUR/USD is rising, and I want to go long (buy a call), I want to see GBP/USD rising as well. Since these pairs are highly correlated, they should move together. If they are not, it warns me that maybe I should pay more attention to my trading. This doesn’t mean I won’t trade – because correlations change and the two pairs are never in perfect sync – it just means I have very good reasons to take the trade (as you always should anyway). should be).

Correlation can be a complicated statistical topic, but hopefully this introduction will familiarize you enough with the concepts to do your own homework as well. Check correlation studies often to be aware of correlations between forex pairs that may be affecting your trading. Use correlation data to control risk, spot opportunities and filter trades. If you are having trouble visualizing how correlations work, try looking at the figures in correlation tables and then pulling up the price charts of the two forex pairs in question. Note how the pairs move relative to each other; Doing so will help build a general understanding of correlations.

forex signals

Forex represents rich prey for signals and alert services. With no central market and many driving factors, volatility is high. Forex pairs are traded 24 hours a day for 5 and a half days of the week. The trading volume of the currency traded is huge. All these factors mean that the opportunities are huge, and signal services regularly provide trading tips.

As a more established trading vehicle, signal providers for Forex are more established than binary platforms. Many of the best services have been running well for over 10 years. So potential customers can check a large amount of past performance to see how well the service is doing.

Service providers also have more confidence in their systems given their long-term performance. For merchants, this means a free trial, or a discounted subscription for new customers. Signal services know that traders will only be affected through results – so they encourage traders to make them risk free.

Best Forex Signal Provider?

We have seen a lot of forex signal services and related advertisements. For us, results are the important thing. To that end, we suggest Signal Hive offers the best forex signals, and here is why:

Take a look at these monthly performance statistics – since 2004:

This service, named Master T-2000 v2, has given annual profit for about 14 years. Signal Hive is a market place for various systems, but this one is the most consistent. The performance of 14 years cannot be ignored.

Importantly, you don’t have to take our word for it. It is available on a free trial that the firm operates. So you can get these signals absolutely free of cost, without any risk.

The software can be automated with some of the major brokers. With MetaTrader 4 integration and real-time indicators, the software is as good as anything we’ve seen. After the free trial, the full pro service costs $50 per month. If you are not satisfied after the trial period, simply walk away.

drill into signal details

Beyond the headline numbers, the system is ultra consistent. Data can be analyzed hourly, or per day of the week and over longer periods, each period is profitable. So the software and algorithm simply select solid trades.

Signal Hive provides a range of signals – as the name suggests. In addition to the Master T-2000 v2, there is a system call MELISA (Multi-Entry Logic Investment and Saving Algorithm). This algorithm tends to perform well during times of volatility in more traditional markets. Again, it has shown a profit each year for the past 14 years. With investors currently looking for safe havens, this system could provide an element of diversification.

All of these systems and more are available at Signal Hive, and with no strings attached, free trials on offer, there’s no harm in giving them a try.