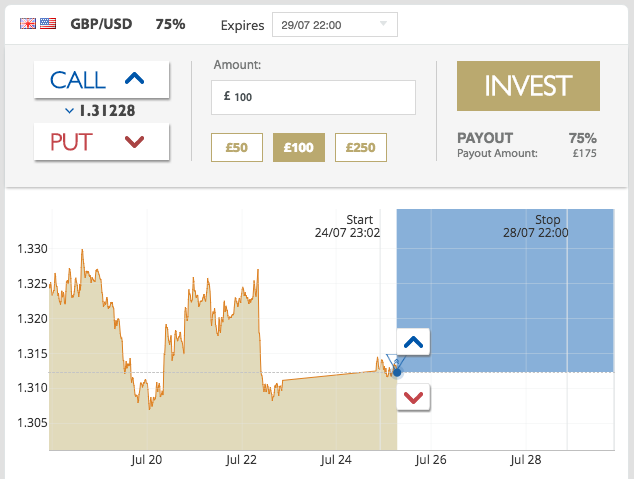

ETX no longer offers binary options.

They still offer Forex and CFD trading.

| Broker | ETX Capital |

| the headquarters | London, UK |

| support type | Email, Telephone, Web Form |

| Dialect | Arabic, Chinese, Czech, Dutch, French, German, Hungarian, Italian, Polish, Portuguese, Romanian, Russian, Spanish and Turkish |

| trading platform | Proprietary |

| minimum 1 deposit | £ / $ / € 200 |

| minimum account size | £ / $ / € 200 |

| minimum trade amount | Minimum bet size of 50p (subject to margin requirement) |

| Bonus | Deposit match from 20% to 50% depending on deposit size. up to a maximum of £5,000 |

| regulator | Financial Conduct Authority, UK |

| Deposit Methods | Major Credit Cards and Wire Transfers |

| trading methods | Spot Forex, CFDs, Classic Binary Options, 60 Second Options, Long Term Options, Pair Options and Spread Betting |

| number of assets | N/A |

| asset type | Currencies, Commodities, Indices, Stocks |

| tablet trading | |

| mobile trading | |

| overall score | 92/100 |

Formerly known as TradIndex, ETX Capital is a state-of-the-art online trading service provider owned and managed by Monecor Ltd. is near. Based in London UK, ETX Capital is regulated by the Financial Conductors Authority (FCA) under registration number 194721. , ETX Capital is no newcomer to the online trading industry. In fact the parent company, Monecore Limited, has been around since 1965. With a single trading account, ETX Capital traders can trade with four different types of trading platforms with access to over 6000 different instruments. Although ETX Capital offers its traders doesn’t offer the benefits of social trading, yet they have a lot to offer.

Trading Platforms and Features

Unlike most other brokers, a major advantage of ETX Capital is the ability for traders to access up to 4 different types of trading platforms with just one trading account. Only one With a trading account, traders on this platform can trade binaries with the ETXBinary platform, spread betting with ETX Trader and spot forex with TraderPro. More For sophisticated traders, ETX Capital also offers them the advantage of the popular MetaTrader 4 platform. The MT4 platform allows traders to optimize their trading activities with Expert Advisors (EAs). allowing them more free time to focus on their analysis of the markets.

Furthermore, all of the above-mentioned platforms are also mobile compatible. ETX Capital has made it possible for its traders to access the platform from anywhere in the world with their smartphone or mobile device for free from Gole Play or the Apple Store. Accessing your trading accounts is made easy by downloading the Trading App.

market coverage

ETX Capital traders can access over 6000 different types of financial assets with their trading platform. For Forex, the leverage available now is just 1: is 30.

Trading Accounts

ETX Capital only offers a standard type of trading account for its traders. Opening a live trading account is a simple process and only requires a few clicks of the mouse.< /span> To make things even easier, ETX Capital only requires a minimum deposit of £ / $ / € 200 depending on the currency chosen for the trading account.< /span> Demo accounts are also available in case traders wish to test the trading platform before depositing any real funds.

customer support

The standard of customer support at ETX Capital is to be commended. While support services are not available 24/7, they are available in Arabic, Chinese, Czech, Dutch, French, German, Hungarian, Available in several major languages such as Italian, Polish, Portuguese, Romanian, Russian, Spanish and Turkish. The only drawback with support services is the lack of live chat. < span class=”notranslate”> All requests for support are to be transmitted via email or via a toll-free Universal International Freephone Number (UIFN).

Spreads, Payouts and Bonuses

For spreads payable, traders can choose between fixed (ETXTrader) and variable spreads (ETXCapital & ETX MT4). The lowest spread for the popular EUR/USD pair is 0.7 pip. For the bonus, they go up to 60%. However, to qualify for the bonus For this, traders are required to keep a minimum of £/$/€1000 in deposit.

conclusion

While this broker may not be the biggest broker around, they still have a lot to offer traders in terms of quality services. Trade with multiple trading platforms In addition to being able to trade, traders at ETX Capital enjoy ultra tight spreads as well as dedicated customer support.