social trading

Social trading is a new way of investing. It’s the simple concept of basing business decisions on the wisdom of the crowd. Investors share details of trades – others can then access this user generated financial analysis. The growth of social media has led to an explosion in publicly shared trading information.

Social trading is shared between traders, creating a wealth of market sentiment data. Individuals can follow the trades of others, or lead, and share their own trades.

social trading brokers

| Broker | regulated | minimum deposit | Payment | Bonus | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Sorry, but no broker matched the criteria for the country you come from (India). Please visit our Brokers page to see all the brokers that accept traders from your location. Or reload this page with location filtering enabled. | |||||||||||||||||||

Brokers are filtered based on your location (India). Reload this page with location filtering

What is social trading?

Since the advent of online trading, the social aspect of the activity has represented a natural and powerful draw for investors looking for shortcuts to easy profits. Social trading has gone through many incarnations over the years and at this point, it is safe to say that it is here to stay.

For many beginners, this presents a somewhat clear path toward success, as well as a realistic understanding of how profitable a business needs to be.

How does this work?

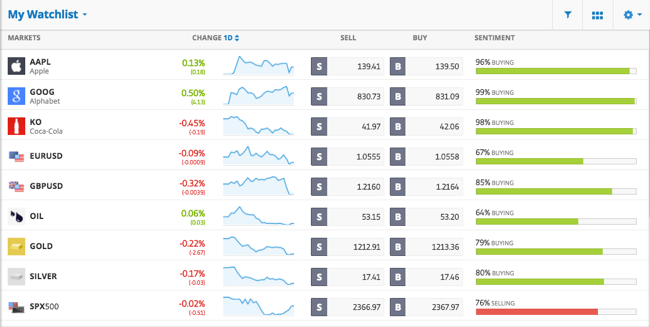

It is a process where online traders place their own trades based on data generated by other users from various trading platforms. This can be by watching sentiment, or simply copying the trades of other traders who regularly make profits.

There are many online operations built specifically on such user-generated financial data. They cover a wide range of business models. According to one study, around 80% of online brokers offer some form of social trading. In fact, social trading has permeated an entire industry from bottom to top.

The most basic social trading channels come in the form of social media-based signal groups. There are operators such as eToro, which have built entire businesses on their own proprietary platforms, based on social interaction between traders.

More recently, chat-based work groups focused on business have also emerged with specially developed and designed platforms, allowing members of such groups to collaborate on a never-before-seen level.

Benefits of Social Trading

The appeal and top selling point of social trading is that it creates a kind of symbiotic relationship between those providing useful data and those consuming it. It also represents a simple ‘entry level’ option for beginners and novices – learn from others, judge how they are making decisions and improve your own trading – all hopefully using others’ strategies. Still making profit.

With the right kind of copy trading strategy, those who have mastered their trade can make decent money. Traders can make profit not only from their trades but also from the ones that are followed. The broker will financially reward popular traders. Either through better trading terms, or straight commission.

Followers will find that the benefits can be twofold. Firstly, this easy mode of investment can produce good returns. Secondly, however, followers can learn from the profitable traders they follow. The following others may provide a great learning opportunity. However, success depends on choosing the right social traders to follow.

What are the Social Trading Sub-genres?

The most popular form of social trading is copy trading. Copy trading is all about using social networks of traders extensively. These allow followers to link their accounts directly to the accounts of expert traders. The trades of the “Expert” are automatically copied and replicated by the software.

This type of social trading does not require any input from the follower, which explains its popularity. The size of the investment is commensurate with the follower. So a professional forex trader placing trades in excess of £10k, can still only be risked a few pounds by a newbie.

Copy trading gives novice investors a little time to trade on their own, to benefit from the knowledge of other, more experienced, traders.

eToro is arguably the largest and most advanced copy-trading network out there. It offers scores of trading features, expert profile analysis tools and monetization options. It is the total package of copy trading. As such, eToro is the preferred d

online trading made simple

When social trading was first introduced, it was designed to be available to anyone with a web browser. The objective was to make trading and investing simple, enjoyable and profitable. The early pioneers of social trading made sure their platforms where intuitive and user-friendly. The platforms are continually improved, offering new tools and improvements. For example concepts such as “one-click trades” (an eToro feature). The brokers put emphasis on providing free educational tools to the clients and explaining the concept of social trading. Demo accounts are a popular way for traders to get used to the ideas.

On most advanced platforms, traders can open a “Buy” or “Sell” position. They can also set “Stop Loss” and “Take Profit” orders. These are powerful risk management features. They automatically stop transactions when a certain target is met. Similarly, a “stop-loss” will keep a trade open, but if the stop loss makes a trade profit, adjust the loss to the upside. Very useful where traders are not monitoring their positions all the time.

Social Trading on eToro

Offering a cutting-edge, yet simple, trading platform since 2007 and serving over 5 million users in 140 countries – Teatro is currently the world’s leading social trading platform. The platform has over 1,000 assets to trade. They provide clients with powerful charting and analysis tools and a range of social features for managing their online accounts.

In 2010, eToro released its first social trading platform. It has since become an integral part of the platform. The firm enabled traders from all over the world to interact, learn from each other, copy each other and view each other’s portfolios. Roubini Thought Lab predicts that by 2021, one in four traders will be using social trading and investing services.

| Broker | regulated | minimum deposit | Payment | Bonus | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Sorry, but no broker matched the criteria for the country you come from (India). Please visit our Brokers page to see all the brokers that accept traders from your location. Or reload this page with location filtering enabled. | |||||||||||||||||||

Brokers are filtered based on your location (India). Reload this page with location filtering

copy trading explained

Copy trading has grown exponentially since the idea came to the fore. Reflecting the growth of social media and the ability to share information instantly, copy trading (or ‘social’ trading as described above) allows traders to quickly share their trading ideas and strategies Anyone interested. Following these traders can automatically duplicate their trades and profit from them.

the basics

Sometimes referred to both as copy trading or social trading, the idea quickly gained traction because novice investors could watch, – and learn from – and copy – traders. They can piggy back on their winnings and place the same trades at the exact same price. The instantaneous nature of these trades meant that followers weren’t missing out on price movements – they were able to configure their accounts to place exactly the same trades – at exactly the same time – as the traders they followed.

Social trading is very attractive for traders who are taking their first steps in the world of investing. It is often sold as a method for newbies to invest without a heavy amount of research or prior trading experience to get involved. But is copying business more than this? Read on to find out….

How does trading work?

Once a trader has decided that they want to use a copy trading platform for others to follow, they need to find the right traders to follow. This can be done using various methods. Traders can be filtered by performance, trade frequency, the assets they trade – any element of their trading style. Some may look for those with long term results – others may make huge profits in the last few days.

The window above gives you the opportunity to walk through this search process

Once a user finds someone to follow in one-click, they can be sure that they can open every trade that person makes. The actual amounts involved can be tailored – so a person can follow a millionaire forex trader, making lots of trades – perhaps for as little as £1 per position. Once configured, every time a new trade is opened (or closed), the follower will be executed at the same price your trade was opened or closed. Apart from the size of the investment, everything else remains the same.

Traders can copy (or follow) as many different people as they want and mirror all their trades. Of course, they still have the flexibility to opt out of particular trades or eliminate copying altogether. There is no commitment and the follower is in complete control.

Copy Trading Profit

Copy trading can be loosely described as trading socially, sharing information, trades and performance with other people. More specifically, it allows traders to trade full-time themselves without the time or knowledge to follow trades opened by more experienced traders. Those experienced traders also benefit as their broker can give them preferential commission or cashback on the trading volume generated through their followers.

Best brokers offer copy trading

| Broker | regulated | minimum deposit | Payment | Bonus | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Sorry, but no broker matched the criteria for the country you come from (India). Please visit our Brokers page to see all the brokers that accept traders from your location. Or reload this page with location filtering enabled. | |||||||||||||||||||

Brokers are filtered based on your location (India). Reload this page with location filtering

Be an expert and copy

Of course, the description so far is very one-sided. Following other traders has attracted most of the people for social trading. However, there is another side to the coin – those traders who follow themselves. Without those talented, profitable traders, there would be no one to follow, and the model would break down very quickly. So what is the motivation for traders to try and attract followers?

First of all, traders are initially looking to make profits just for their own sake – obviously. They are opening and closing positions with a view to get a good return on their investment for themselves. However, why are they successful in trading with a successful trading platform? Well, brokers will typically reward traders who are followed a significant number of times, generating a portion of their trading volume.

If a trader places a single trade, which the broker makes £1 in commission or through the spread, that is all well and good. What if a single trader makes the same trade, but then has 1,000 users all making the same trade, generating the broker £1000? The broker can then reward the trader with a cut of that commission. Brokerages know that they need to attract good traders to make sure that people actually follow – so a good trader can do this by trading well quickly, attracting users and generating greater trade volume. can generate and increase its own profits.

Who Can Make Best Use Of Copy Trading?

In truth, social trading should appeal to a wide range of investors. Below are three different descriptions of ‘traders’ and how they can best use a social trading platform. Most people will fall into one of these categories;

- traders want to follow others

- The most obvious and most common group of traders. People who may not have the experience, knowledge or even time to analyze the markets or assets and place trades at the best prices. Why not simply follow other profitable traders? [ Follow or Copy ]

- trader eager to learn

- Many traders want to learn more, and are quick to admit that they are not highly profitable traders – yet. However long term, they may want to make all their own decisions and place their own trades. For now, they can mix their trades, learn from more experienced traders – and profit from them. [ follow the lead ]

- Profitable traders, increasing returns

- Established traders, perhaps profitable elsewhere, may see the appeal of additional income purely to follow. In terms of risk management, it is very rare to know that any given trade will generate a certain income. At worst it can cover trading costs, at best it can significantly increase profits. [ lead ]

So it’s clear that most people will fall into one of these groups – and social trading suits all of them. It is probably the middle group – the aspiring traders – who can be reticent about social trading. They don’t specifically want to follow, they want to make their own choices – but why not have the best of both worlds? There’s no reason a trader can’t copy both – and still copy others.

| Broker | regulated | minimum deposit | Payment | Bonus | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Sorry, but no broker matched the criteria for the country you come from (India). Please visit our Brokers page to see all the brokers that accept traders from your location. Or reload this page with location filtering enabled. | |||||||||||||||||||

questions to ask

What is forex social trading?

Forex social trading is the sharing of trading information – whether tips, signals or opinions – but specific to the Forex markets. Social trading will generally include forex assets anyway, but is sometimes referred to separately.

How to start copy trading?

eToro leads the way when it comes to social trading. Their trading platform makes it easy to find other profitable traders and the trading platform is very slick. They offer a demo account where newbies can learn all about social trading – including copying traders with demo funds. A demo account provides the best starting point, allowing traders to try out the platform risk-free.

Copy trade with MT4

Copy trading software providers are not currently widely integrating MetaTrader 4.